Geng Qian

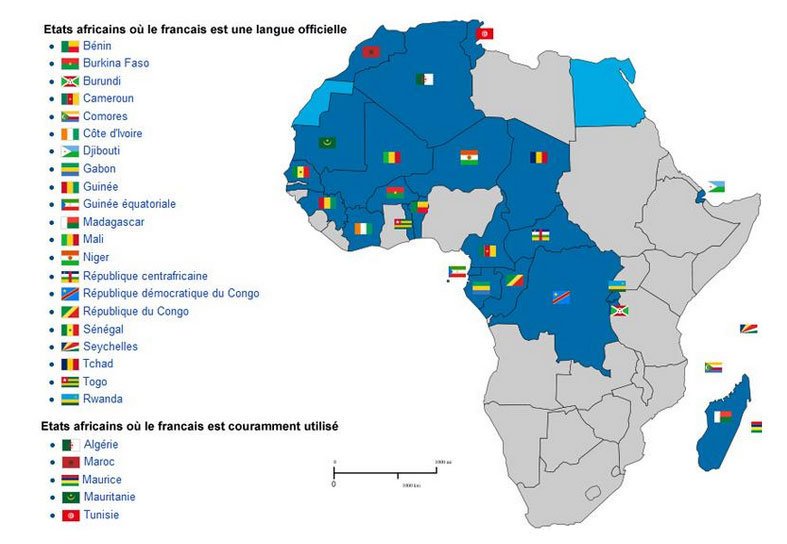

Francophone African countries, distinguished by their unparalleled natural resources, vast market potential, and relatively advantageous investment policies, are progressively emerging as key focal points for Chinese enterprises’ international investments. As Africa’s political climate stabilizes and its economic infrastructure develops steadily, these Francophone nations are increasingly vital in the global expansion strategies of Chinese companies, becoming favored destinations for those seeking to broaden their overseas presence.

However, despite the rich resources and extensive markets, the intricate geopolitical landscape and variable security conditions necessitate constant vigilance from Chinese enterprises, requiring them to conduct thorough risk assessments and implement effective safeguards against potential security threats. Thus, Chinese companies venturing into Francophone African countries must recognize not only the immense commercial opportunities and beneficial investment policies but also possess an in-depth understanding and accurate appraisal of the local political, economic, social, and security contexts. Only through comprehensive risk evaluation and strategic risk management can Chinese enterprises attain stable and sustainable growth in Francophone Africa.

The political terrain within the Francophone sphere is notably diverse, encompassing nations across West, Central, and parts of North and East Africa, each with its own governance structure, from presidential republics to monarchies, resulting in marked variances in political stability. This diversity brings a mix of opportunities and challenges for international investors, particularly for Chinese firms engaged in the Belt and Road Initiative. For example, Côte d’Ivoire and Senegal have demonstrated consistent political stability, economic growth, and success in attracting significant foreign investment.

Côte d’Ivoire, with its advanced agricultural sector and burgeoning industry, has established itself as a pivotal economy in West Africa. Similarly, Senegal, renowned for its stable governance and strategic positioning, has emerged as a magnet for foreign investment. Such examples underscore the critical role of political stability in facilitating economic development and attracting international capital.

Conversely, nations like the Central African Republic and Mali, marred by political upheaval and security challenges, present substantial risks to investment security. The ongoing political crises and conflicts in the Central African Republic have profoundly impacted its socio-economic progress and safety. Mali, grappling with terrorism and internal strife, not only jeopardizes its own stability but also poses direct risks to foreign investments.

Political instability exerts multifaceted effects on the operational and investment security of Chinese companies in the Francophone zone. Political unrest can prompt erratic shifts in governance, injecting uncertainty into corporate strategies and operations. For instance, coups may lead to governmental overhauls, potentially nullifying pre-existing contracts and affecting the feasibility and projected returns of investments. Additionally, political strife and societal turmoil can disrupt public order, endangering corporate assets, personnel, and escalating operational costs in crisis-affected locales.

In such conflict zones, companies might be compelled to allocate additional resources for employee safety or even suspend operations amidst security concerns. Moreover, political crises may provoke international sanctions, adversely affecting the global standing and commercial channels of companies, particularly those heavily reliant on international trade.

Under the auspices of the Belt and Road initiative, Chinese companies are rapidly expanding their presence in Africa, exploring new business opportunities in the resource-abundant Francophone African nations. This strategic endeavor not only revitalizes local economies but also opens up unparalleled opportunities for growth among Chinese businesses.

Nevertheless, this expansion is accompanied by notable challenges, particularly the stark differences in social stability and the escalating social security concerns in certain areas, posing considerable risks to Chinese investments and operations in these regions. The situations in Niger and Burkina Faso exemplify the severity of these challenges.

In recent times, both Niger and Burkina Faso have been plagued by numerous terrorist attacks, significantly affecting the local populace’s lives and directly jeopardizing the safety of foreign businesses, notably including Chinese personnel and assets. The recurrent nature of these attacks not only destabilizes the local security infrastructure but also compels foreign investors to reassess their commitments, occasionally leading to the suspension or complete withdrawal from ongoing projects.

Beyond terrorism, the prevalence of banditry and localized armed conflicts introduces significant operational uncertainties. For example, in Northern Mali, the precarious security situation and frequent armed skirmishes have greatly impeded economic progress and deterred external investments. Operating in these locales, Chinese companies confront multifaceted security threats, ranging from physical violence to criminal activities such as extortion and theft, impacting both the safety of their employees and the security of their assets.

To navigate political risks effectively, Chinese enterprises must employ adaptable and diverse strategies. An exhaustive political risk evaluation is paramount, equipping companies with a comprehensive understanding of potential political hazards. Establishing a robust early warning and emergency response system is critical for prompt risk mitigation. Fostering open dialogue with local governments and communities enhances mutual comprehension, minimizing misunderstandings and disputes. Moreover, investment diversification and leveraging international risk insurance are prudent measures to spread risk and reduce vulnerability in singular investment ventures.

By implementing these strategies, Chinese businesses can adeptly tackle the challenges posed by political instability in Francophone Africa while capitalizing on the region’s extensive investment prospects. In essence, through meticulous risk assessment, effective early warning and emergency protocols, constructive communication, and investment diversification, Chinese enterprises can secure stable investment growth in the Francophone regions of Africa.

Addressing legal risks in Francophone African countries necessitates comprehensive legal due diligence by Chinese enterprises prior to investment, ensuring a thorough grasp of the target country’s legal framework and operational realities. Proactively seeking advice from local legal experts and valuing their insights are crucial steps in protecting enterprise rights and interests throughout the investment and operational stages. Establishing strong, reliable partnerships with local entities aids in collectively mitigating potential legal challenges. In cases of legal disputes, recourse to international legal arbitration offers a pathway to equitable and judicious resolutions.

In addressing environmental safety risks, Chinese enterprises should proactively adopt adaptive strategies to align with the increasingly stringent environmental regulations in Francophone Africa. A critical first step involves strengthening collaboration with local environmental agencies, ensuring investment projects are well-informed about and rigorously comply with local environmental standards.

Additionally, enterprises ought to allocate resources towards conducting comprehensive environmental impact assessments and implementing robust environmental safeguards to mitigate the adverse effects of their operations on the environment. Moreover, the adoption of eco-friendly technologies and practices in production and construction not only mitigates environmental impacts but also bolsters the company’s image and competitive edge in the market.

Through such initiatives, Chinese enterprises can effectively navigate environmental legal challenges and champion sustainable development under the Belt and Road Initiative, fostering mutual prosperity with Francophone African nations.

Facing the escalating social security concerns in Francophone Africa, Chinese enterprises must urgently refine their business strategies. Conducting extensive and meticulous security risk assessments prior to market entry is paramount to gain a thorough understanding of the local security landscape and pinpoint potential hazards. Enterprises need to develop a holistic and effective security management framework, encompassing emergency preparedness, enhancing employee safety consciousness and self-defense skills, and fostering close ties with local security entities.

Employing advanced technology to improve security management efficacy stands as a crucial strategy for overcoming security challenges. For instance, deploying surveillance systems and utilizing satellite positioning and communication tech enables real-time monitoring of staff and assets, facilitating swift reactions to emerging security threats. Furthermore, actively engaging in local community development projects can address the root causes of social security issues by uplifting living and economic conditions. Promoting community development and social stability can be achieved through initiatives such as constructing educational and healthcare facilities and offering vocational training.

In conclusion, while Francophone African countries present vast investment prospects for Chinese enterprises, they are not without their challenges. To navigate these successfully, Chinese companies must implement a holistic risk management approach, encompassing political risk evaluation, legal due diligence, environmental precautions, and social security enhancement. By undertaking these strategies, Chinese enterprises can not only realize commercial triumphs in the Francophone region but also contribute significantly to the local socio-economic landscape, fostering mutual benefits and win-win outcomes.

*The author is affiliated with the School of Arts and Sciences at Yunnan Normal University (College of Arts and Sciences Kunming) and specializes in research on issues related to French-speaking African countries.

**The opinions in this article are the author’s own and may not represent the views of The Diplomatic Insight. The organization does not endorse or assume responsibility for the content.

Established in December 2008, The Diplomatic Insight is Pakistan’s premier diplomacy and foreign affairs magazine, available in both digital and print formats.