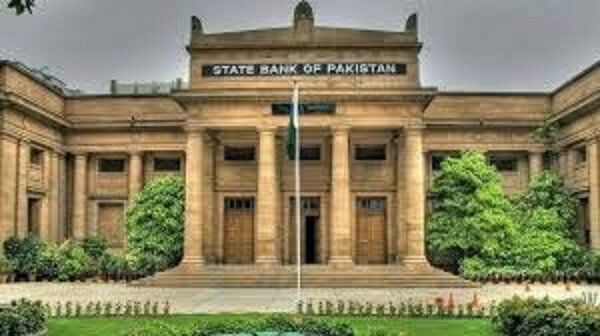

Islamabad/Karachi (TDI): The Governor of the State Bank of Pakistan (SBP) stressed the importance of expanding credit for climate-resilient and sustainable projects, aligning Pakistan’s financial sector with global sustainability goals.

Speaking at InfraZamin Pakistan’s event, “Enabling Green Financing and Green Bonds via Credit Enhancement Solutions,” he discussed Pakistan’s vulnerability to climate change, referencing the 2022 floods that caused nearly $30 billion in damages.

Read More: Pakistan and UAE Climate Change Collaboration

The Governor shared that SBP has included climate change risk as a key theme in its Strategic Plan 2023-28.

This Plan outlines a range of goals and policy initiatives for the next five years to ensure sustainable growth.

“This theme aligns with other themes in the Plan, including technological innovation, diversity and inclusion, productivity and competitiveness, and strategic communications,” said the Governor.

He affirmed Pakistan’s commitment to the Paris Agreement, aiming to cut emissions by 15% by 2030, with potential for an additional 35% reduction pending external financing.

SBP’s renewable energy initiatives have financed over 4,500 projects, and the bank is developing a “Green Taxonomy” with the World Bank to streamline green investment classification.

Also Read: SBP takes measures to fight inflation

The event also featured addresses from Mr. Philip Skinner, Head of Middle East, North Africa, and Pakistan at GuarantCo & Origination Lead at Nature at PIDG, Ms. Maheen Rahman, CEO of InfraZamin Pakistan and Mr. Muneer Kamal, CEO and Secretary General of the Pakistan Banks’ Association.