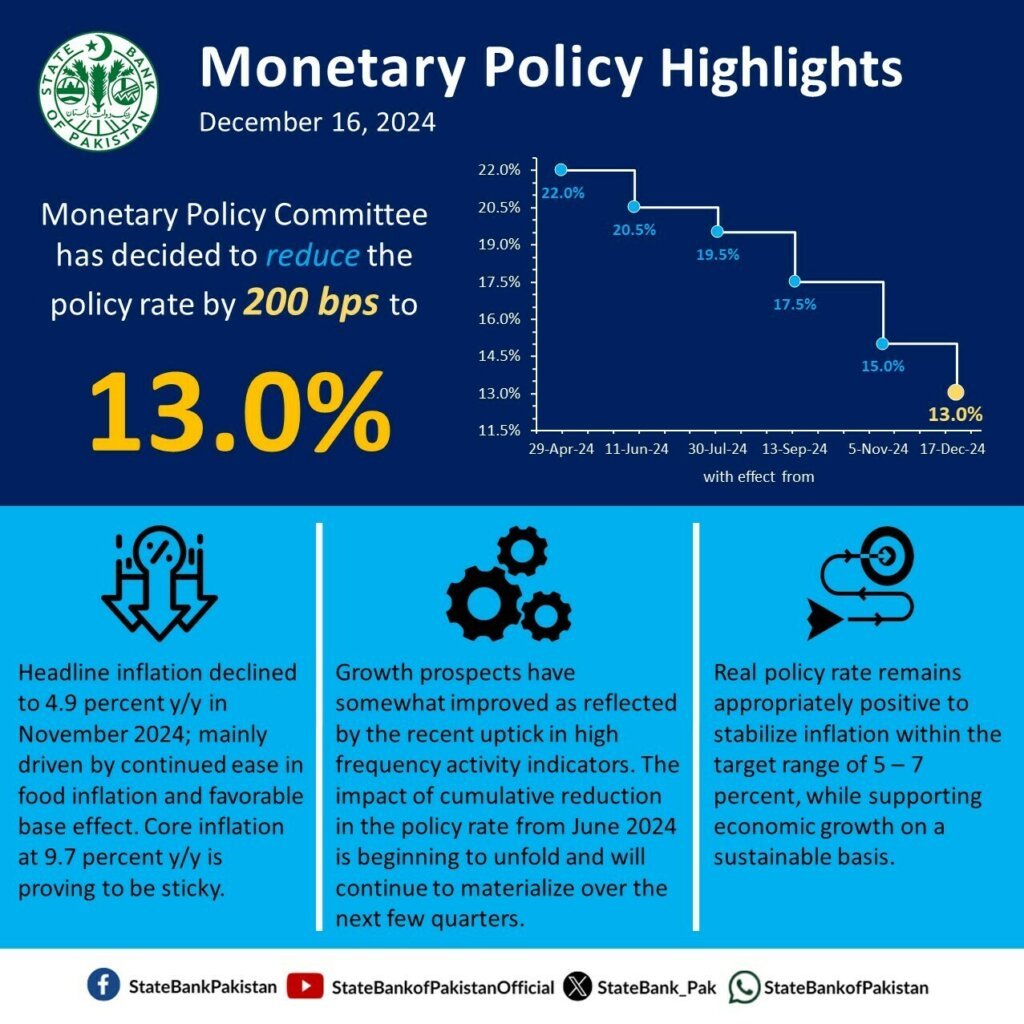

Islamabad (TDI): The State Bank of Pakistan’s (SBP) Monetary Policy Committee (MPC) announced Monday it was reducing the key policy rate by 200 basis points (bps) to bring it down to 13 per cent.

This is the fifth consecutive policy rate cut by the central bank, which comes amid a decline in the headline and core inflation.

Read More: Economic Indicators: Analysts Predict Policy Rate Cut

In the last review, the SBP had slashed the key policy rate by 250bps to bring it down to 15%.

This is also the most aggressive policy rate cut since April 2020. During the Covid-19 pandemic, the central bank slashed the rate by 200bps to bring it down from 11% to 9%.

Read More: SBP Slashes Key Policy Rate by 200bps to 17.5%

“Headline inflation declined to 4.9% y/y in November 2024, in line with the MPC’s expectations. This deceleration was mainly driven by the continued decline in food inflation as well as the phasing out of the impact of the hike in gas tariffs in November 2023.

“However, the Committee noted that core inflation, at 9.7%, is proving to be sticky, whereas inflation expectations of consumers and businesses remain volatile. To this effect, the Committee reiterated its previous assessment that inflation may remain volatile in the near term before stabilizing in the target range.