The global inflation wave has dealt a severe blow to Pakistan’s economy, and it is facing unprecedented economic turmoil, with the inflation rate rising rampantly.

In this globalized world, integration with the global economy is beneficial but it is not costless, for domestic economies especially if it is not properly managed after the global shocks which is the case with Pakistan.

A series of compounding issues such as fiscal inability in the wake of the pandemic, rising food and energy prices, and consumer insecurity have created a new global recession across the globe.

In the backdrop of global inflation and recent flash floods, the economic outlook for Pakistan is likely to remain below the target.

It is believed that global inflation in the fiscal year 2022 will reach 7.4%, and it will exacerbate further. All of this has resulted in continuous stagnation of economic growth in Pakistan, with average inflation estimated to be up to 12% in the fiscal year 2022.

Macroeconomic imbalances

The government of Pakistan has expressed concerns regarding the country’s economy, saying that the country’s economic growth is facing challenges due to wider macroeconomic imbalances.

Pakistan is currently facing several severe challenges such as rising inflation, high external deficits, declining foreign exchange reserves, exchange rate depreciation, and mounting uncertainty.

Depreciation of Currency

Another implication for Pakistan of high inflation globally is the depreciation of the currency, which results in slumping exchange rates.

Though, this is mostly the case with weaker currencies like Pakistan whose purchasing power is reduced to a huge extent leading to inflation.

The local currency has depreciated by 16.7 percent since July 2022 against the US dollar which itself feeds into higher domestic inflation.

This currency depreciation is leading to an increase in the debt burden of Pakistan. Moreover, the country’s foreign exchange reserves have also fallen sharply in the past few months.

Rising Import Prices

The ongoing depreciation of the rupee both against the US dollar and on a trade-weighted basis against the currencies of Pakistan’s main trading partners is a cause of concern as it makes imported raw materials more expensive.

When imports become expensive, it leads to a rising trade deficit for the country as well. According to the Pakistan Bureau of Statistics, the trade deficit of Pakistan rose by 28.89% in August, climbing to $3.53 billion compared to $2.73 billion in July 2022.

Increase in Oil Prices

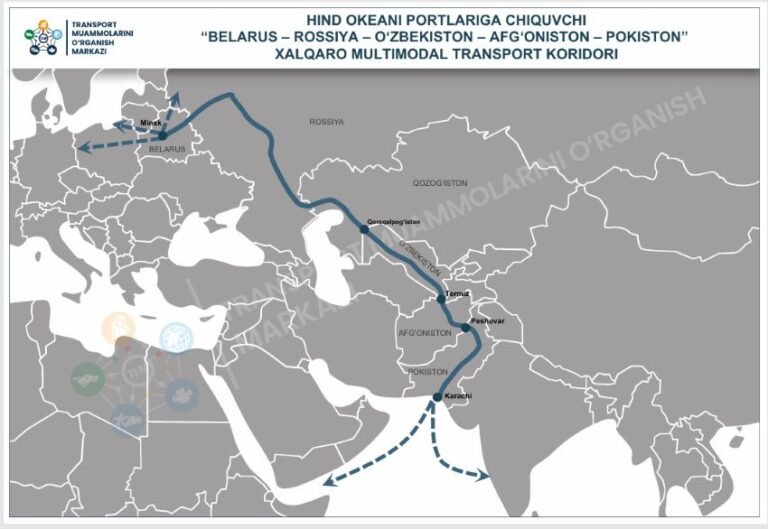

As Pakistan imports 80% oil and 35% gas from abroad, which is one-third of Pakistan’s total imports, it makes us heavily dependent on global oil price movements, and thus global market fluctuations weigh heavily on the national import bill of Pakistan and also put pressure on our domestic markets.

These rising international oil prices lead to an imbalance whether on the fiscal or on the external side as said by the central bank governor of Pakistan.

The recent surge in oil prices in Pakistan is also a result of global inflation in the wake of COVID-19 and the Russia-Ukraine conflict.

The rising oil prices have become a headache for the South Asian economy as it already faces dwindling foreign exchange reserves. Moreover, the country’s oil imports have jumped up to $20 billion as well.

The expensive Liquified natural gas (LNG) and Liquified petroleum gas (LPG) agreements with Qatar in July 2022 have also increased oil prices in the country.

The government of Pakistan targets to collect Rs 750 billion on account of the petroleum development levy in the next fiscal year 2022-23.

Lowering Interest rates

Also, due to the rise in global inflation, the instability in the economy leads us to receive foreign remittances and aid, so there is an increase in the money supply.

The fluctuations in the money supply and the lowering of the interest rates fuel inflation. The increased consumption and investment expenditure in the economy causes a rise in aggregate demand.

Also read: SBP takes measures to fight inflation

This subsequent increase in aggregate demand also leads to growing inflationary pressures in Pakistan’s economy.

According to the State Bank, Pakistan’s three months interest rate was reported at 15.77% pa in September 2022, compared to 15.92% pa in the previous month.

Escalation in Indirect taxes

Moreover, due to global inflation, Pakistan’s tax collection relies heavily on regressive indirect taxes. These taxes include customs, sales, and federal excise duty taxes.

These taxes are hardly pro-poor, and the increase in global inflation due to rising prices eventually leads to a rise in indirect taxes.

Due to the recent surge in inflation globally, the government of Pakistan is planning to raise an enormous total tax collection target of Rs 7.9 trillion through new taxes worth Rs 400-450 billion.

It also includes additional taxes on higher income salary brackets, raising 4.7 trillion through indirect tax measures.

This increase in indirect taxes collection resultantly depreciates the living standards of the common man and also widens the income disparity as well.

Conclusion

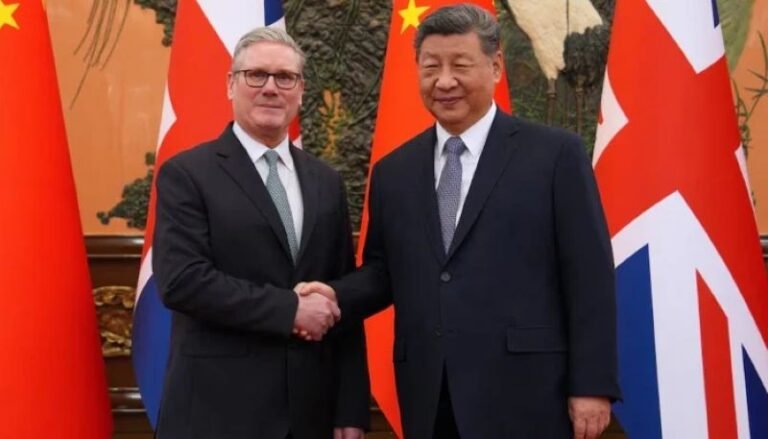

The new coalition government of Pakistan aims to stop the rising inflation in the country with an enhanced IMF package and more short-term loans from Saudi Arabia and China.

However, the long-standing structural weaknesses of the economy including low exports, low investment, and low productivity growth, pose a significant risk to a sustained recovery.

The budget for FY2023 aims to stabilize economic growth, increase revenues, enhance exports and protect the vulnerable segments of society through relief measures and pro-poor initiatives.

However, the country’s economy has been affected severely by widespread destruction brought on by recent floods.

Therefore, the government now needs to come up with innovative ideas to narrow down the yawning budget deficit, ensure debt sustainability, and coordinate fiscal and monetary policy.

In short, the government of Pakistan needs to introduce sound policies and prudent policymaking to navigate the current situation of rising inflation across the country.

*The writer is a Fellow at The Diplomatic Insight, published by the Institute of Peace and Diplomatic Studies

**The Diplomatic Insight does not take any position on issues and the views represented herein are those of the author(s) and do not necessarily reflect the views of The Diplomatic Insight and its staff.