ISLAMABAD (TDI): China’s central bank reduced interest rates and injecting liquidity into the banking system, aiming to steer economic growth back toward this year’s target of approximately 5%.

This move is part of a final push for stimulus ahead of the week-long holidays starting October 1.

China Cuts Interest Rate

Following a recent meeting of the Communist Party’s top leaders, which highlighted the urgent need to address economic challenges.

Read More: Gulf Central Banks Slash Interest Rates

The government plans to issue special sovereign bonds worth around 2 trillion yuan ($284.43 billion) this year as part of its fiscal stimulus strategy.

Mark Williams, Chief Asia Economist at Capital Economics, estimates that this package could boost annual output by 0.4% compared to earlier projections.

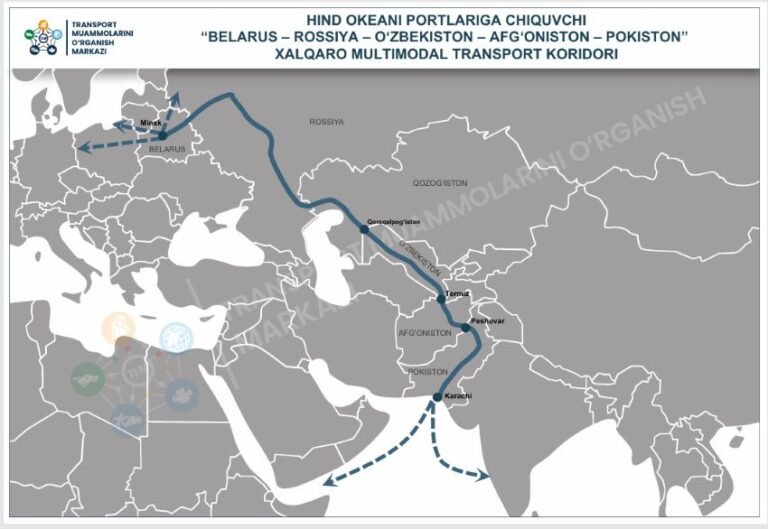

Also Read More: China and Central Asian Countries Ink Cooperation Agreement for BRI

While it is late in the year, Williams believes that if the new stimulus is implemented swiftly, it could help achieve the “around 5%” growth target.

Chinese stocks are on track for their best week since 2008 amid these stimulus expectations.

However, the economy faces significant deflationary pressures due to a sharp decline in the property market and weak consumer confidence, revealing its heavy reliance on exports in a tense global trade environment.